Stop calculating your retirement taxes based on your current paycheck.

This is the single most expensive math error high-earners make. It relies on a false assumption: that earning money and spending money are taxed the same way. They are not.

Here is the breakdown of why earning $100,000 today is radically different than withdrawing $100,000 in retirement.

The Earning Side: The “Top Dollar” Problem

When you are working, every extra dollar you earn (or save) is taxed at your highest rate. This is your Marginal Rate.

If you are a single filer making $100k, you are in the 22% bracket.

- The Reality: If you earn another $1,000, the IRS takes $220.

- The Opportunity: If you put that $1,000 into a Traditional 401k, you save $220 instantly.

You are saving taxes at your absolute highest pain point.

The Withdrawal Side: The “Fill the Bucket” Strategy

Fast forward to retirement. You have $2M in a Traditional IRA and you decide to withdraw $100,000 to live on.

Crucial Math: You do NOT pay 22% on that $100k.

Why? Because the US tax system is progressive. You have to fill up the cheap buckets first before you touch the expensive ones.

The 2024 Tax Buckets (Single)

The 0% Bucket (Standard Deduction): The first $15,000 you withdraw is completely TAX FREE.

- Tax Paid: $0 (Standard Deduction)

The 10% Bucket: The next ~$11,925 is taxed at only 10%.

- Tax Paid: $1,192.50

The 12% Bucket: The next ~$36,550 is taxed at only 12%.

- Tax Paid: $4,386

The 22% Bucket: The next ~$36,525 is taxed at 22%.

- Tax Paid: $8,035.50

The Scoreboard

You just withdrew $100,000 from your pre-tax accounts.

- Total Tax Bill: $13,614

- Effective Tax Rate: ~13.6%

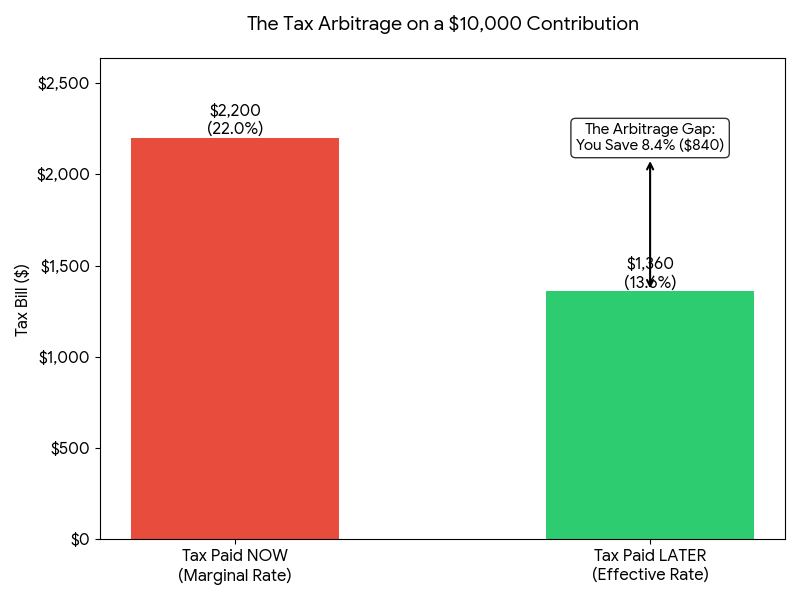

The Verdict: The Arbitrage Win

This is the “Free Money” spread that Roth zealots miss:

- While Working: You avoided paying 22% tax on your contributions.

- While Retired: You paid an effective rate of 13.6% on the withdrawals.

You pocketed the 8.4% difference.

On a $1,000,000 portfolio, understanding this “Tax Arbitrage” is worth $84,000 in pure, risk-free profit.

The Lesson: Stop obsessing over “Tax Free Growth” (Roth) and start obsessing over “Tax Arbitrage” (Traditional). If your current marginal rate is higher than your future effective rate, the Traditional 401k wins every time. Consider that even if the tax rates increase by 50% you’ll still net positive with a 401k over a Roth and until you hit RMDs you determine how much you withdraw so you can determine how much taxes you pay.

Read Next

Now that you understand the “Tax Buckets,” let’s apply it to the most common debate in investing. 👉 Stop Donating to the IRS: Why Traditional Beats Roth

Disclaimer: This content is for educational purposes only and does not constitute financial advice. I am not a financial advisor. Please consult with a qualified professional before making financial decisions.