We spend entirely too much time agonizing over Monte Carlo simulations, tax-drag coefficients, and 40-page financial plans. While those have their place, they often lead to “analysis paralysis.”

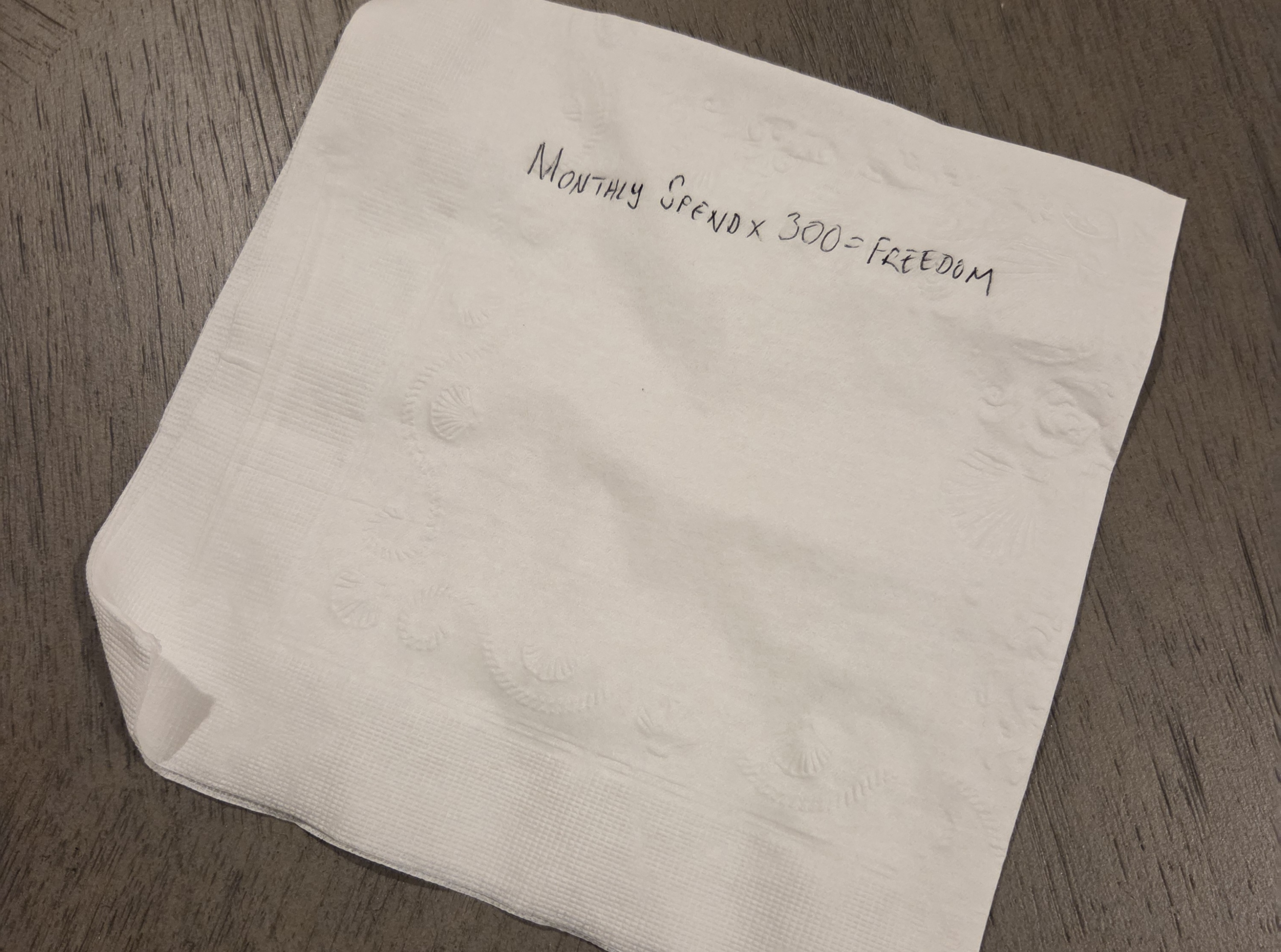

Sometimes, you just need a target to aim at. You need to know: “How much is enough?”

Here is the absolute simplest way to calculate your retirement number.

1. Calculate Your Actual Annual Need

Don’t use your income. Use your spending.

Take your average monthly expenses from the last 12 months. Now, make two critical adjustments:

- Subtract Savings: You won’t be saving for retirement in retirement, so remove those line items.

- Subtract the Mortgage (Optional): If you plan to have a paid-off house by the time you retire, remove the Principal and Interest payments (but keep taxes and insurance!).

2. The Rule of 25

Take that adjusted monthly number, multiply it by 12 to get your annual need, and then multiply that by 25.

This is based on the 4% Rule, which suggests you can safely withdraw 4% of your portfolio annually without running out of money for at least 30 years.

3. The “Bridge Gap” (Why We Ignore Social Security)

You might be asking: “But wait, shouldn’t I subtract my future Social Security checks from my monthly need?”

No. Here is why.

If you retire early (say, at 50) but can’t claim Social Security until 67, you have a 17-year “Bridge Gap” where you must fund 100% of your life. If you reduce your savings target now expecting that government check, you will run out of money before the first check arrives.

The Strategy: Calculate your number as if Social Security doesn’t exist. Let your portfolio carry the full weight. When the checks eventually start arriving in your 60s, treat them as your inflation hedge, your healthcare buffer, or the “bonus” that ensures you never run out.

The Calculator

I built this simple tool to do the math for you.

It takes your adjusted spending and your timeline, then tells you exactly how much you need to contribute monthly to hit your date.

(Note: For the return rate, I recommend being conservative. The S&P 500 historically returns about 10%, but using 7% or 8% adds a layer of safety.)