Everyone loves the Roth IRA. It is the golden child of the personal finance world. “Pay taxes now,” they say, “so you never have to pay them again!”

It sounds great emotionally. Mathematically, for the average engineer or professional, it is often a mistake.

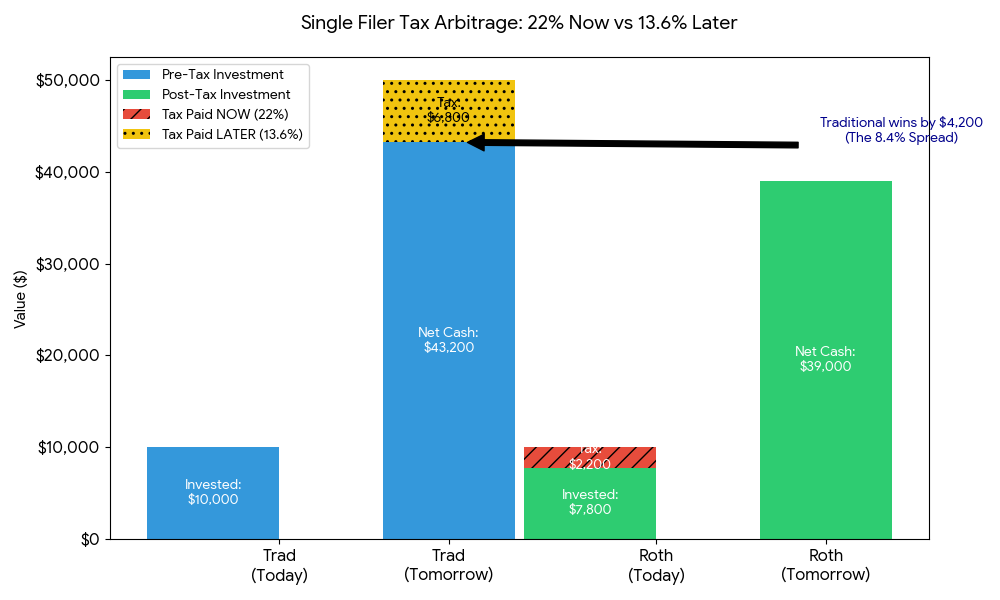

If you are earning $100,000, you are firmly in the 22% Federal Tax Bracket (plus state taxes). By choosing a Roth, you are volunteering to pay that 22% rate on money you don’t plan to touch for decades.

The $100k Trap

Let’s say you earn $100,000 a year. Every extra dollar you earn (or fail to deduct) costs you 22 cents in federal tax alone.

You have $7,000 to invest in an IRA. You have two choices:

Option A: The Roth IRA (The “Tax Me” Strategy)

You take your $7,000 paycheck and put it in a Roth.

- Cost to you: You had to earn ~$9,000 gross to get that $7,000 net.

- Taxes Paid: You handed the IRS ~$2,000 immediately.

- Benefit: It grows tax-free.

Option B: The Traditional IRA (The “Tax Deduction” Strategy)

You put $7,000 into a Traditional IRA.

- Cost to you: $7,000.

- Taxes Paid: $0. In fact, you lower your taxable income, saving you $1,540 in federal taxes this year.

- Benefit: You have more cash flow now to invest elsewhere.

The “Lock-In” Problem

When you choose Roth, you are locking in your current 22% rate forever.

You are betting: “My EFFECTIVE tax rate in retirement will be HIGHER than 22%.”

Read that again. Do you really think your average tax rate in retirement—when you fill up the standard deduction and low brackets first—will be higher than your marginal rate while working full-time?

For 90% of people, the answer is no.

The Retirement Math

In retirement, you don’t withdraw at your marginal rate. You fill up the “Buckets” (Standard Deduction, 10%, 12%).

- Today: You pay 22% to put money into a Roth.

- Tomorrow: You might pay an effective average of 8-10% to take money out of a Traditional.

By choosing Roth, you are voluntarily paying a 12% premium just to avoid doing a little tax math later.

When Roth Actually Makes Sense

I am not saying Roth is useless. Use Roth if:

- You are just starting out: If you earn $40k/year, you are in the 12% bracket. Pay the tax now; it’s cheap.

- You are a super-saver: You have maxed out your 401k and Traditional IRA and need a place for extra savings (Backdoor Roth).

- Hedge against tyranny: You believe tax rates will double in 20 years (e.g., the lowest bracket becomes 25%).

The Verdict

Stop optimizing for “Tax Free.” Start optimizing for “Net Worth.”

For the $100k earner, the Traditional IRA (and 401k) is the most powerful wealth-building tool available. It gives you the tax break when you need it most (now) and lets you pay the tax when it costs the least (later).

Take the deduction. Invest the difference. Keep the change.

Read Next

Taxes are defensive. Let’s talk about playing defense with your spending. 👉 Why I Like Credit Cards (And You Should Too)

Disclaimer: This content is for educational purposes only and does not constitute financial advice. I am not a financial advisor. Please consult with a qualified professional before making financial decisions.